A Tuesday Trade Edition: One of the most important concepts in trading is to review your work, and learn from the good and the bad. It’s critical to identify what’s working — to do more of it. Each week, you’ll get a trade from my trading journal, in which I explain my whole thought process from start to finish. Trading is all about finding something that works, and applying it, over and over again. That’s how you find trading success. So study up on this “Tuesday Trade” and let’s get to work.

Last Thursday I talked about the psychology of what happens when there’s a gap. Traders ask me about gaps all the time, and how I deal with them. Ironically, I dealt with one recently, so I figured it was a great opportunity to write about it.

First of all, I really don’t experience bad gaps like this very often. And when I do, they’re usually recoverable. But even then, based on my analysis and what my tools showed me, I knew this one wasn’t recoverable.

What exactly does that mean…?

Well, let’s start with the trade.

Here we were trading Zoom, and as you know it’s basically just gone straight higher, as it’s one of the hot COVID stocks. I’ve said all year that I’d continue trading these COVID “hot stocks” until they stopped working, and Zoom was no exception.

The Setup:

We had a great trend that you could see on the Trend Strength Turbo Candles as it continued to go higher. And when it pulled back to the 50 period simple, that’s where I started to get long again (because it was following a pattern).

But here’s what actually ended up happening…

News came out over the weekend about a COVID vaccine. The news said that this particular vaccine was going to be 90% effective. So Zoom, along with the rest of the COVID stocks, gapped down 15%.

When dealing with gaps (like this one) and the losses that can often accompany them, it’s good to go back and review trading psychology. Check out this combo class from John Carter and me where we cover just that (p.s. it’s on sale).

The Trade:

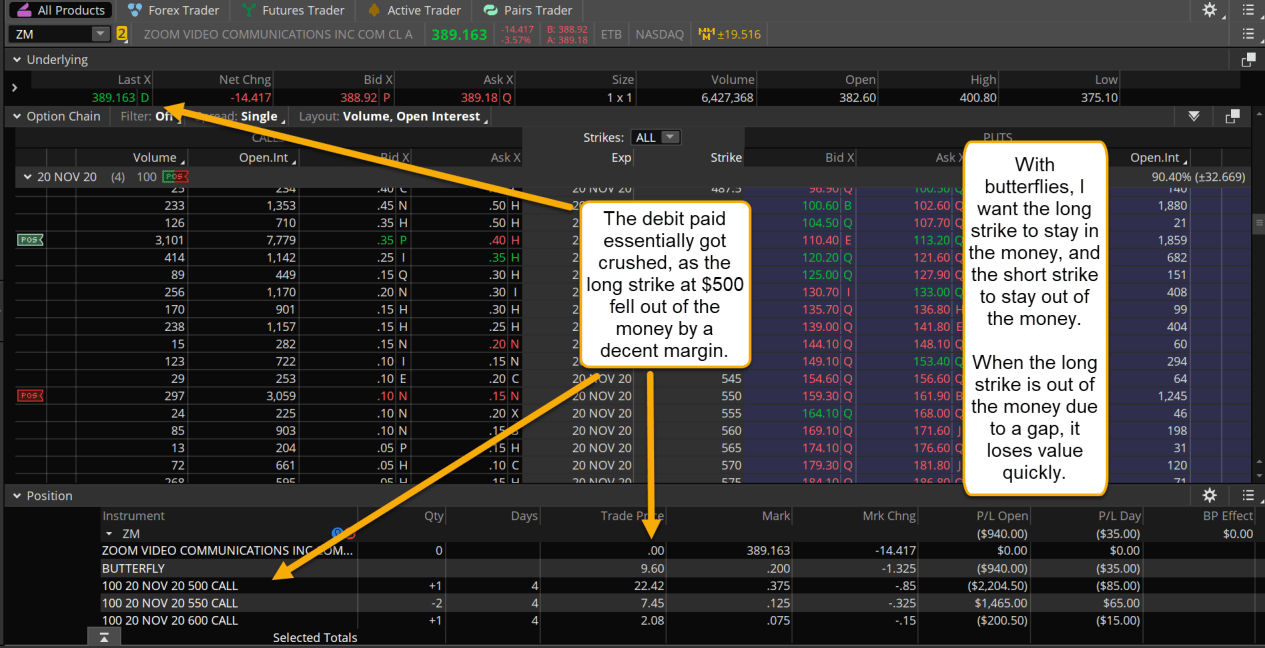

For this particular trade, I had a butterfly that was 500, 550, and 600, that meant that my strikes were all the way up here at basically the top of the chart.

The worst part of all this? Those flys were doing great… until Zoom gapped down.

Now what happened in this instance was that the butterfly gapped down below 500, and you can see with the Trend Strength Candles that they turned red and a blue dot appeared. What’s that mean? A confirmed downtrend and a high volume move.

Post Gap:

The first day after the gap down I didn’t really do anything because when a ticker gaps down to this extreme you usually can’t’ even take a stop because the IV and the premium are just crushed on it.

So I waited for the second day…

On the second day, it gapped down even further. And the Turbo VZO actually gave a volume sell single BEFORE I got into the trade. It ended up displaying negative volume showing that this ticker wasn’t coming back at all.

Since the butterfly was out of the money by such a significant margin, the debate was totally crushed. The 500 call used to be worth $22, now it’s worth $0.32. That’s not what you want to see AT ALL in a butterfly. The short calls, yes, you do want to see those get crushed, but you need to have long calls to maintain their value.

What was left to do at this point then?

I had noted that I would’ve liked to have taken a 50% stop if it didn’t work out, but because of the gap I wasn’t able to do that. So this was one of the first max losses that I’ve had in awhile.

A Max Loss:

Ya, it didn’t feel good obviously… but max losses do happen in trading. That’s why Henry will always say “Hey, don’t even plan on tracking a 50% stop, risk the max amount you’re willing to lose because events like this can happen.”

And so the event happened.

In this instance, it’s a bit of a double-edged sword because it was good news that a potential COVID vaccine had a high effective rate. However, the way that news affected Zoom was very negative, and I happened to be trading Zoom at the time.

Going Forward:

When stuff like this happens, I always think it’s a great idea to revisit your trading psychology. No one likes losing, and especially a max loss at that. So if you find yourself, have found yourself, or just want to make sure you’re up to speed for when this happens to you in the future… check out “The Ultimate Options Beginner Toolkit.” It’s a combo class from John Carter and me, and it’s actually on sale right now which is always a bonus. During the class, we cover exactly what it means to focus on trading psychology as well as taming your trade monster (and more).