Hey traders!

This week, I wanted to highlight analysis from my friend and well-respected colleague, Mary Ellen McGonagle! She primarily focuses on stocks with a 2-week to 9-month horizon depending on market conditions. She has some great tips on how to capitalize on the current uptrend taking place!

Check out her guest newsletter below to learn more.

Growth Stocks On The Move And How To Capitalize Should The Rally Continue

Over the past 7 weeks, the Nasdaq has outperformed the S&P 500 by a wide margin and today, I’ll share with you why this outperformance has taken shape, and what to be on the lookout for going forward.

Nasdaq vs S&P 500 vs Dow

To begin, when discussing Growth stocks, it’s important to note that these are faster growing companies that are in areas such as Technology, Retail, Medical Products and Internet related names.

Many of these Growth stocks are in the Nasdaq and they have been the hardest hit in the current bear market, as they do not fare well during periods of high inflation. This is because the value of their future earnings are decreased due to the diminishing value of the dollar. Another negative impact for Growth stocks is high interest rates which also reduces the value of future growth.

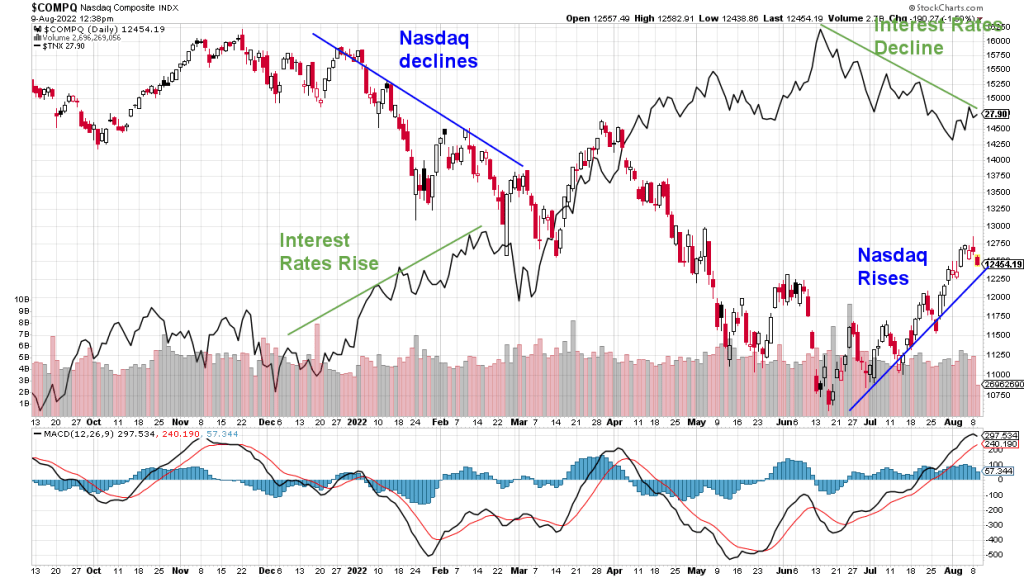

Nasdaq and Interest Rates

In the chart below, I’ve highlighted the rise in interest rates late last year (using the yield on the 10-year Treasury) and as you’ll see, the Nasdaq fell in value. Beginning 7-weeks ago, Interest rates have been declining and it correlates directly with the rally in the Nasdaq.

Another reason Growth stocks are outperforming is because these beaten down companies are reporting quarterly earnings results that are above estimates.

That dynamic may be shifting today however, as several high profile Semiconductor companies have been issuing warnings regarding lowered growth outlook for this year. In response, other areas of Technology are selling.

Provided Growth stocks stabilize, we can use the example below as a guide on how to participate in it’s potential upside price movement.

CloudFlare Inc. (NET)

Above is Software Security stock Cloudflare (NET) and as you can see, it’s well off its November peak in price. This is a well respected company in its industry and they reported earnings on Thursday that were 150% greater than last year and 200% above estimates.

Investors responded very favorably with demand pushing the stock into a gap up in price Friday morning on very heavy volume. In addition, the rally helped push the MACD into positive territory with the RSI already in positive territory. These are both momentum indicators. The next area of upside resistance is the 200-day moving average which is 28.5% away.

Also of note is the fact that Software stocks overall have been in an uptrend after other well known companies experienced similar price action after positive quarterly results (using ETF IGV). It’s critical that the Industry Group that your selected stock is a part of is in an uptrend as 33% of your stock’s appreciation will be due to that.

To look at precedence for other Software stocks that have traded higher after gapping up in price on earnings, take a look at Atlassian (TEAM)

Strong Growth Stocks Criteria

Using the criteria listed above, in order to participate in the strong Growth stocks that remain in a bullish uptrend, you’ll want 1) quarterly results above estimates 2) stock to gap up in price or simply trade higher on above average volume 3) be part of an industry group that’s in favor 4) make sure the broader markets are in an uptrend 5) keep an eye on interest rates as rising rates may stall Growth stocks.

At this time, the broader markets have quite a bit to digest with inflation reports due out later this week which may have a negative impact. These reports will be closely watched as they will impact the Federal Reserve’s decision on whether to raise interest rates aggressively to fight inflation.

For those who’d like to be alerted to any shift in the current market’s uptrend or have access to my select list of buy ideas, sign up for the 30-day trial to my twice weekly MEM Edge Report for just $7.

Warmly,

Mary Ellen McGonagle

Editor, MEM Edge Report